🔥 [New] How to Set Tax-Inclusive Price for POS Retail Order?

Update Time: 18 Nov 2025 11:07

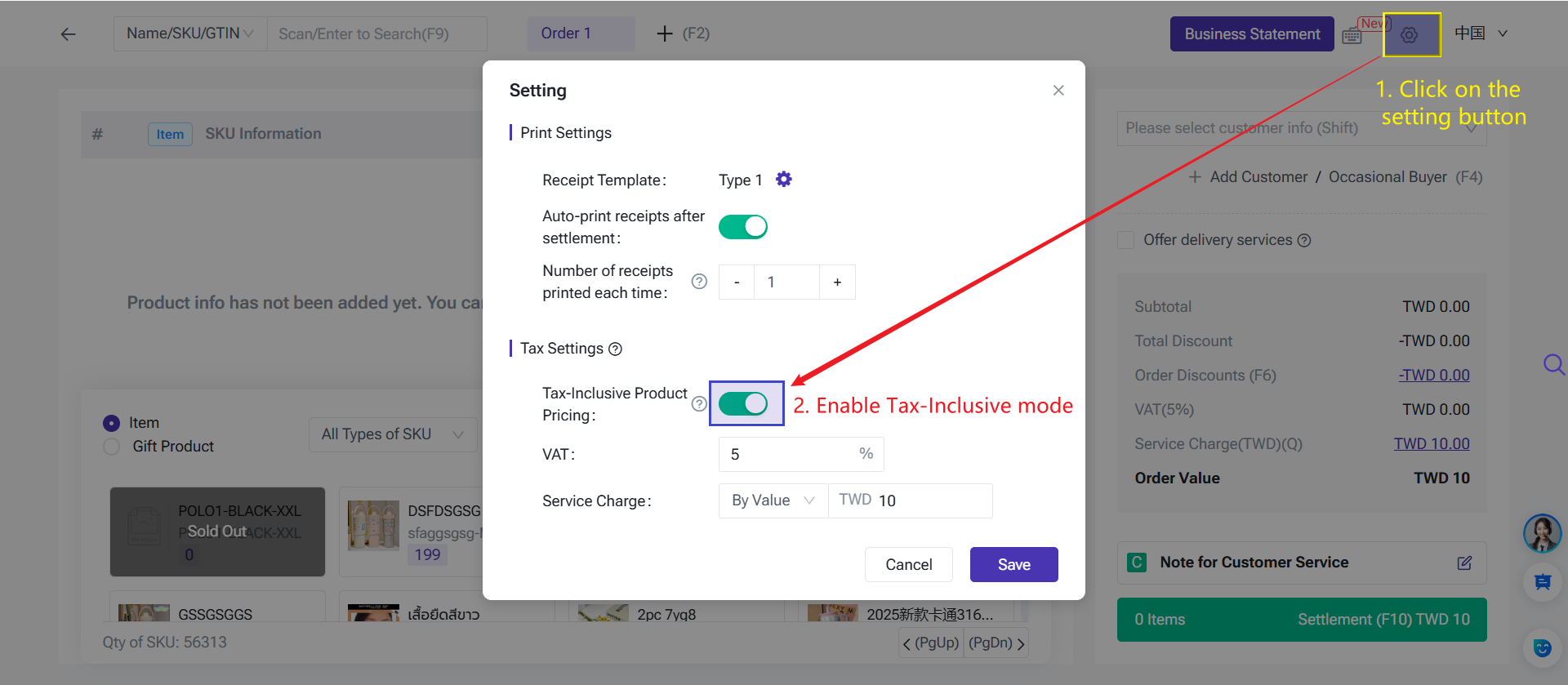

1. Enable Product Prices Include Tax

- Product unit price and total price are considered tax-inclusive.

- The system will not apply tax again.

1. If your current POS Business Statement is open and contains revenue, you must close the bill before enabling or disabling tax-inclusive mode.

- If Store A enables tax-inclusive pricing, all POS orders in Store A will display and use tax-inclusive prices.

- If Store B keeps the setting disabled, its POS orders will continue using tax-exclusive prices.

2. Page Changes

After enabling tax-inclusive mode:

- Unit Price is updated to Unit Price (Tax-Inclusive)

- Total Price is updated to Total Price (Tax-Inclusive)

- In the order amount details, Product Subtotal will display as Product Total (Tax-Inclusive)

3. Editing Tax-Inclusive Unit Price

- You can click on the product unit price to modify the tax-inclusive price for the current order.

- Your changes will only affect the current order. If you would like to modify the SKU’s default selling price, please go to Marketing > POS Retail Price page.

4. FAQ

Q1: After enabling tax-inclusive pricing, do I still need to calculate tax manually?

A1: No. The system automatically handles tax and avoids double taxation.

- Order Value = Product Total Tax-Inclusive− Product Discounts − Order Discounts + Service Charge + Shipping Fee

- VAT = (Product Total Tax-Inclusive − Product Discounts − Order Discounts) ÷ (1 + Tax Rate) × Tax Rate

- Product Total (Pre-Tax) = (Product Total Tax-Inclusive − Product Discounts − Order Discounts) ÷ (1 + Tax Rate)

Service Fee Calculation:

- By percentage: Service Fee = Pre-Tax Product Total × Percentage

- By fixed amount: Service Fee = Entered Amount

Example: Order Value Details

| Item | Tax-Inclusive Price | Tax-Exclusive Price |

| Product Subtotal | 100 | 100 |

| Product Total Discount | -10 | -10 |

| Order Discounts | -10 | -10 |

| VAT (10%) | 7.27 | 8 |

| Service Charge (10%) | 7.27 | 8 |

| Shipping Fee | 10 | 10 |

| Order Value | 97.27 | 106 |

Q2: How are product prices displayed on receipts and in order details when tax-inclusive mode is enabled?

A2: In tax-inclusive mode, all product prices on receipts and in order amount details are tax-inclusive. Tax is automatically handled based on the tax-inclusive price, so no manual adjustments are needed. Receipts will reflect the tax-inclusive status of the order at the time it was created.

POS Receipt

Order Detail Page

Business Statement

Is this content helpful?

Thank you for your feedback. It drives us to provide better service.

Please contact us if the document can't answer your questions