-

Orders: Manual or messenger orders, based on enabled credit channels.

-

Payment Receipts: Generated after payment is collected.

-

After-Sales Orders: Created for returns, refunds, or exchanges, when the return status is "Returned" or a refund-only is approved.

-

Opening Credit: Generated when credit is enabled and an opening credit amount is set.

-

Opening Balance: Generated when credit is enabled and an opening customer balance is set.

- Order Cancellations: Automatically generated, with the settled amount transferred to the customer balance.

- Refund Order: Automatically generated after creating a manual after-sales order and confirming the refund.

🔥 [New] Introduction to Credit Term Management (Customer Reconciliation)

Update Time: 31 Dec 2025 03:09

BigSeller has launched the Credit Term Management feature, which supports both manual and messenger orders, helping sellers to:

- Set credit terms and credit limits for customers, allowing flexible management of different customers’ payment cycles.

- Automatically calculate the received and credit amounts for each order, reducing manual calculation errors.

- Review detailed transaction records of all past orders, ensuring real-time synchronization and clear traceability of credit term data.

- Separately display and summarize overdue orders, making it easier to follow up on payments promptly and reduce the risk of missed or overdue collections.

- The credit term feature is currently not supported when importing manual orders in bulk.

- POS orders are not yet supported for the credit sales feature.

- Messenger orders are included in the payment term only after the orders are approved on Order Entry > Pending Order page.

1. How to enable credit for a customer and set up credit information

Method 1: Set during offline order creation

When creating messenger order, or manual order, you can enable and configure the credit feature while adding or editing the customer.

Method 2: Set in the Customer List

Go to Customer List, and enable Credit Allowed when adding a new customer or editing an existing one.

Configurable Options When Enabling Credit

- Select Order Type: Supports enabling credit term for Manual Orders and Messenger Orders.

- Account Period (days): Set the customer’s fixed repayment cycle (leave blank if no fixed term).

- Maximum Credit Limit: Maximum allowed credit for the customer (leave blank for no limit).

- Opening Credit Amount: The customer’s initial outstanding balance.

- Opening Customer Balance: The customer’s initial available balance.

2. Order Payment Operations

Payment Methods:

- COD (Cash on Delivery): The customer must pay the full order amount; credit is not supported.

- Prepaid: You can choose from different payment methods (e.g., credit card, cash, account balance, etc.).

- If the payment amount is less than the order total, the system will automatically record the difference as credit: Credit Amount = Total Order Value – Received Amount

- If the customer has a balance in their account, it can be used to offset the order amount. Any remaining unpaid portion will automatically be recorded as credit.

After the order is created, you can view the credit records and payment status for the order in Customer Reconciliation.

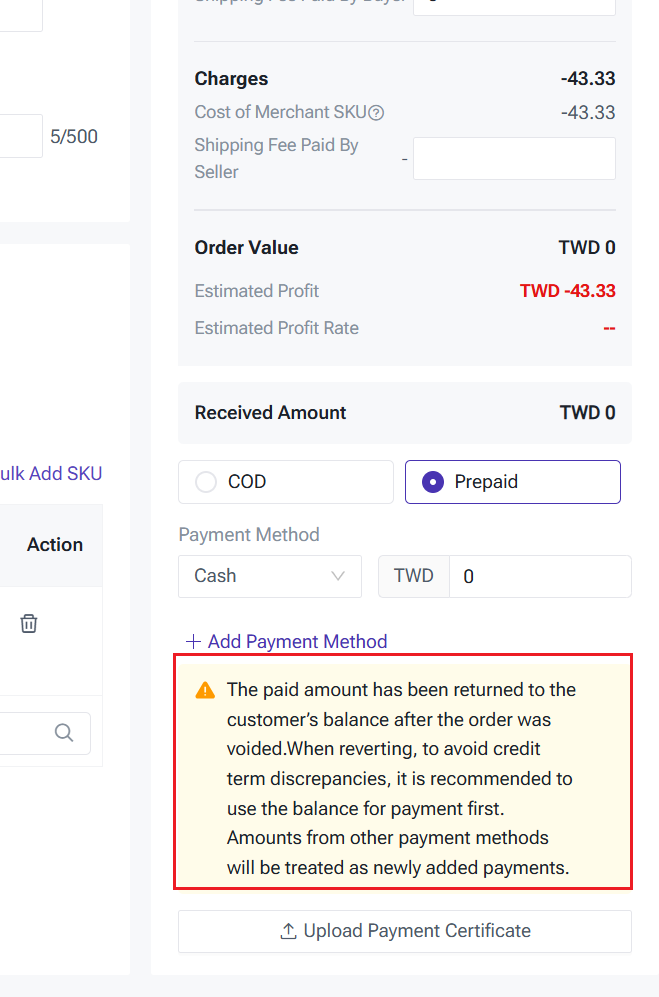

💡Please note: Voided orders can have their amounts edited. Any paid amount will be refunded to the customer's balance. When reverting an order, it's recommended to prioritize balance payment to avoid accounting discrepancies. Payments made via other methods will be treated as new transactions. Reverting vioded order adds a new entry to the customer’s reconciliation: 'Reverting an order,' which is equivalent to creating a new bill.

3. Customer Reconciliation Page Guide

Page Access: Go to Report Module > Finance Report > Customer Reconciliation or Marketing Module > Customer Manage > Customer Reconciliation to view all customers’ credit details and reconciliation information.

The Customer Reconciliation page is mainly used to view customer credit data and perform operations such as Receive Payment and reconciliation.

3.1 Data Overview

- Credit Customers: The number of customers with credit enabled.

- Total Credit: Total credit amount across all customers in the system.

- Due Customers: Number of customers whose credit term has expired.

- Due Amount: Total credit amount of all customers whose terms are due.

Filtering and Search:

You can filter customers using multiple criteria to quickly find your target:By Customer Level: View credit information for a specific customer level.

1) By Credit Status

- No Credit Status: Display all customers, including those with and without credit amounts.

- Has Credit Amount: Only show customers with outstanding credit.

- No Credit Amount: Only show customers with no credit records.

2) By Credit Term Status

- No Cedit Term: Customers without a set credit term.

- Due: View details of customers whose credit term has expired.

- Not Yet Due: View details of customers whose credit term is not yet due.

For example, if a manual order is created or a messenger order is approved on the 1st with a 1-day credit term, the payment due date will be the 2nd.

3.2 Reconciliation

On the Customer Reconciliation page, click the Reconciliation button in the action column on the right to enter the customer account records page.

Here, you can view in real time the customer’s total credit, account balance, changes in credit, payment records, and detailed account transactions.

Whenever you perform operations such as setting an opening credit, entering a payment, creating an order, or canceling an order, the system will automatically generate corresponding account records for any financial changes, making reconciliation and tracking easier, which includes the following order types:

💡 Explanation of List Fields

| Field | Meaning | Positive / Negative Logic |

| Date | Date the document was issued | — |

| Order Type | Order / Receipt / Opening Balance / Opening Credit / Order Cancellation, etc. | — |

| Document No. | Order | — |

| Receivable | Amount receivable for this transaction | Positive: Amount the customer should pay Negative: Amount to be refunded |

| Received | Actual amount received for this transaction | Positive: Actual amount received Negative: Actual refund amount |

| Credit Change | Change in credit for this document | Positive: Credit increased Negative: Credit decreased (Unsettled orders are settled; Unsettled orders are refunded) |

| Balance Change | Amount added to or deducted from the stored balance in this document | Positive: Balance increased Negative: Balance decreased |

| Total Credit | Previous total credit + current credit change | Positive value |

| Total Balance | Previous total balance + current balance change | Positive value |

Notes for Aftersales Orders (Refund-Only and Return & Refund)

3.3 Receive Payment

Step 1: On the Customer Reconciliation page, click the Receive Payment button on the right to enter the payment page and create a payment record.

Step 2: Confirm customer information. The top of the page will display the customer’s name, level, customer code, and other details.

Step 3: The lower section shows all the customer's orders and outstanding amounts. You can use filters to view the orders that need to be settled.

| Field | Meaning |

| Order Value | The total amount of the current order. Only unsettled or partially settled orders are displayed. |

| Order Settlement Status | The settlement status of the order: Unsettled, or Partially Settled. |

| Released | The amount that has been collected and settled in the order. |

| Unsettled | The amount that remains unsettled in the current order. |

| Credit Due Date | The date by which the customer should pay the remaining balance. The system will automatically calculate this based on the set payment term (N days after the order date). |

Step 4: Select the settlement scope.

- If you choose All Orders, the system will automatically settle starting from the earliest order.

- If you choose Selected Orders, the system will only settle the orders that have been checked.

Step 5: Enter payment information. Input the payment amount for this transaction (required). If needed, click Upload Payment Proof to add transfer screenshots or receipts.

Step 6: Click the Confirm Payment button at the bottom.

. The system will automatically generate a payment receipt and update the customer’s reconciliation information.

Note: How After-Sales Refunds Affect Customer Credit

If a customer has an outstanding credit balance, any after-sales refund will first be used to offset the customer's unpaid credit amount. Once the unpaid amount is fully offset, any remaining refund can either be returned to the customer or added to their account balance.For more information, please refer to Introduction to Manual After Sales Order (Manual Entry of After-Sales Orders)

1) Credit Offset Calculation Logic

- Refund amount: For example, the customer requests a refund of PHP 100.

- Unsettled amount: Suppose PHP 30 of the order has been settled, and PHP 70 remains as credit (unsettled).

- The requested refund amount

- The unsettled amount

- Refund requested: PHP 100

- Unsettled amount: PHP 70

- → Credit offset = PHP 70

- If refunding to customer balance:

-

Balance change = Refund amount − Credit offset

-

Example: Refund PHP 100, offset PHP 70 → credit decreases by PHP 70; customer balance increases by PHP 30.

-

- If refunding to a bank account:

- The credit decreases by PHP 70.

- Balance change = 0 (the refund is returned directly to the customer; balance does not change).

3) Reconciliation (When a refund order is generated)

-

Receivable = Refund Amount (negative)

-

Amount Received = Refund Amount – Cumulative Offset (negative)

-

Credit Change = Credit Offset (negative)

-

Balance Change (only applies if using "Customer Balance" method)

-

If refunded to Bank Account → no balance change

-

If refunded to Customer Balance → there is a balance change (positive)

-

▶Video Tutorial

Is this content helpful?

Thank you for your feedback. It drives us to provide better service.

Please contact us if the document can't answer your questions